PERSONAL TAX RELIEF 2025

- Childcare Relief

- Individual income tax relief up to RM3,000 for childcare centres and kindergartens will be extended until year of assessment 2027.

- Skim Simpanan Pendidikan Nasional Relief

- The Skim Simpanan Pendidikan Nasional (SSPN) tax relief up to RM8,000 will be extended until year of assessment 2027.

- Education and Medical Insurance Relief

- Education and medical insurance relief will be increased to RM4,000.

- Starting from the year of assessment 2025.

- Private Retirement Scheme Relief

- Deferred Annuity and Private Retirement Scheme (PRS)tax relief up to RM 3,000 will be extended until year of assessment 2030.

- Disabled Individual Relief

- Further tax relief for disabled individual will be increased to RM7,000.

- Further tax relief for individual with a disabled spouse will be increased to RM6,000.

- Further tax relief for individual with unmarried disabled children will be increased to RM8,000.

- Starting from year of assessment 2025.

- Housing Loan Interest Relief

- Tax relief on the interest payments for the first residential home loan:

- UP TO RM 500,000 – RM 7,000

- ABOVE 500,000 TO 750,000 – RM 5,000

- For the sales and purchase agreement executed from 1 January 2025 until 31 December 2027.

- *Terms and conditions applied

- Tax relief on the interest payments for the first residential home loan:

- 2% Dividend Tax on Individual Shareholders

- Annual dividends income exceeding RM100,000 will subject to a 2% dividend tax.

- Starting from year of assessment 2025

- Domestic Food Waste Composting Machine Relief

- Tax relief up to RM2,500 for electric vehicle (EV) charging facility will be expanded to include purchase of food waste composting machines for household use from year of assessment 2025 until 2027.

- Foreign Sources Income by Individuals

- The tax exemption on foreign source income (FSI) received by individuals in Malaysia will be extended until December 31, 2036. This extension is part of the government’s ongoing efforts to attract foreign investments and support Malaysian expatriates by providing favorable tax conditions.

- Medical Expenses Relief

- Starting from the Year of Assessment 2025, tax relief for medical treatment expenses will be expanded to include costs for purchasing self-testing medical devices and fees for disease detection examinations conducted at clinics or hospitals. This relief is capped at RM1,000 and applies to expenses incurred for the taxpayer, their spouse, and children.

- Starting from the Year of Assessment 2025, the tax relief for assessment and diagnosis, early intervention programs, and continuous rehabilitation treatment for children under 18 will increase to RM6,000. This enhancement aims to support families in managing the costs associated with necessary medical and therapeutic services for children, especially those with special needs or disabilities.

- Starting from the Year of Assessment 2025, tax relief for medical expenses will be expanded to include a portion of medical payments made by taxpayers under medical and health insurance and takaful products that feature co-payment options. This relief is capped at RM10,000 and is designed to alleviate the financial burden of healthcare costs for taxpayers.

- Sport Activities, Health and Elderly Care Relief

- Individual Income Tax Relief

- Sports Equipment and Activities: The existing tax relief for sports equipment and activities, capped at RM1,000, will now be extended to include expenses incurred by parents. This encourages parents to promote sports participation among their children.

- Medical Check-up Expenses: The tax exemption for full medical check-up expenses for parents, also limited to RM1,000, will be expanded to cover vaccinations. This aligns with public health initiatives aimed at improving preventive care for the elderly.

- Medical and Parental Care Expenses: The relief for medical treatment and special needs expenses will be broadened to include costs associated with the care of grandparents. This reflects a growing recognition of the importance of supporting multi-generational families and ensuring comprehensive care for elderly family members.

- Individual Income Tax Exemption

- Starting from the Year of Assessment 2025, the income tax exemption of up to RM3,000 per year currently given for childcare allowances provided by employers will be expanded to include elderly care. This means employees will now receive tax exemptions not only for childcare but also for care provided to their parents or grandparents. This is a great step forward in supporting both family and elder care, helping ease the financial burden on working individuals.

- Individual Income Tax Relief

- Exemption on Sport Reward

- A tax exemption will be granted on cash prizes won by individual and team athletes through the Victory Prize Scheme (Skim Hadiah Kemenangan Sukan) provided by the government via the National Sports Council of Malaysia (Majlis Sukan Negara, MSN). This exemption aims to encourage and reward sporting excellence among Malaysian athletes.

CORPORATE TAX

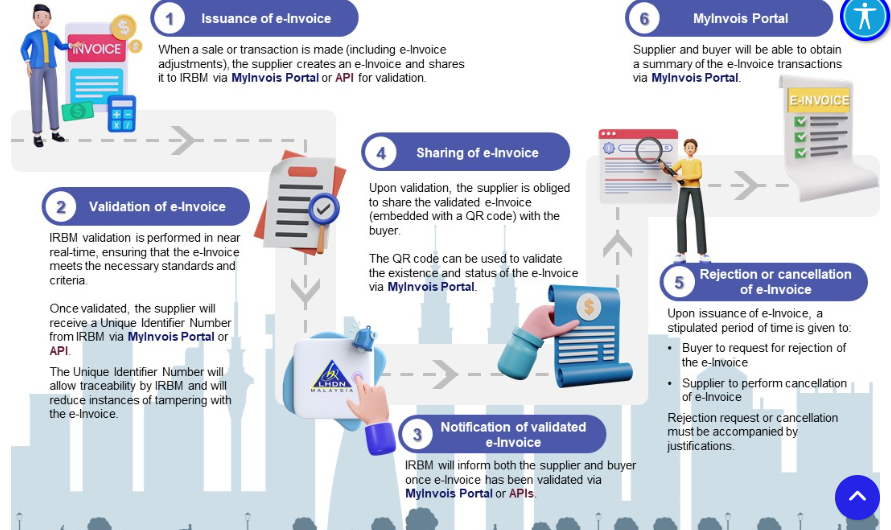

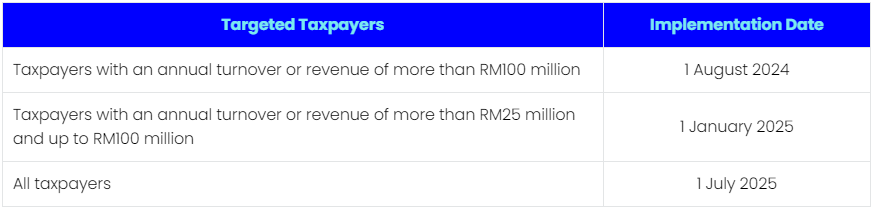

- Tax Incentives for Implementation of E-Invoicing

- From the Year of Assessment (YA) 2024 to YA 2025, businesses will be able to benefit from accelerated capital allowances for the purchase of ICT equipment, software, and associated consulting fees. These allowances can be claimed within a two-year period, allowing businesses to recover their investments in digital tools and services more quickly.

- Extension of Tax Deduction for Sponsorship of

Smart Artificial Intelligence Driven Reverse Vending

- To promote plastic waste recycling and boost recycling rates, tax deductions for sponsoring Smart AI-Driven Reverse Vending Machines will be extended for an additional two years. This extension will be in effect from January 1, 2025, until December 31, 2026.

- Tax Incentive for Employers Implementing

Flexible Work Arrangements (FWA)

- Employers who submit applications to Talent Corporation Malaysia Berhad between January 1, 2025, and December 31, 2027, will be eligible for an additional 50% tax deduction on expenses related to capacity building and software acquisition for implementing Flexible Working Arrangements (FWA). This deduction is capped at RM500,000 and can only be claimed once.

- Tax Incentive for Hiring Women returning to work

- Employers who submit applications to Talent Corporation Malaysia Berhad between January 1, 2025, and December 31, 2027, will qualify for an additional 50% tax deduction on employment expenses for hiring women who are returning to the workforce. This deduction applies for up to 12 months.

- Tax Incentive for Employers Providing Caregiving

Leave Benefits

- Employers who offer additional paid leave of up to 12 months to employees serving as caregivers will be eligible for an extra 50% tax deduction. This incentive is available from January 1, 2025, through December 31, 2027.

- Tax Deduction on the Cost of Developing New

Courses at Private Higher Education Institutions (PHEIs)

- Starting from the Year of Assessment (YA) 2025 until YA 2030, private higher education institutions (PHEIs) are eligible for a tax deduction on the costs incurred in developing new courses, which can be claimed in the same assessment year. This deduction has been expanded to also cover the development of Technical and Vocational Education and Training (TVET) courses by private skills training institutions.

- Benefits given to Technical and Vocational

Education and Training (TVET) sector

- Effective from the Year of Assessment (YA) 2025 to YA 2027, tax deductions will be available for the donation of new equipment and machinery to registered Public Skills Training Institutions (ILKA), polytechnics, or vocational colleges. This initiative aims to encourage businesses to contribute to the development of technical and vocational education by supporting these institutions with essential resources. This tax incentive is part of a broader strategy to enhance skills training and workforce development in Malaysia, promoting collaboration between the private sector and educational institutions.

- Enhancement

of TVET education and training opportunities by Human Resource Development

Corporation (HRD Corp) through implementation of MADINI Training Program

- Employers will be able to utilize the Human Resources Development Corporation (HRDC) levy to provide allowances of up to RM1,000 per year for graduates participating in skills training programs through HRD Corp. This initiative is designed to encourage employers to invest in the development of their workforce by supporting graduates as they gain essential skills and experience. By leveraging HRDC levy in this manner, employers can enhance their training programs while fostering a skilled labor market that meets the needs of various industries.

- Accelerated Capital Allowance (ACA) and Income

Tax Exemption on Qualifying Capital Expenditure on Automation Equipment

- The Malaysian government is implementing a tax incentive that offers Accelerated Capital Allowance (ACA) of 100% on qualifying capital expenditures related to automation equipment in the manufacturing, service, agriculture, and commodity sectors. This includes an income tax exemption on the same qualifying expenditure. This initiative aims to encourage companies to invest in advanced technologies, such as drones and artificial intelligence (AI), particularly in agricultural operations. By doing so, businesses can enhance productivity and efficiency while reducing their reliance on foreign labor. These measures are part of the government’s broader strategy to modernize the workforce and enhance technological adoption across various industries.

- Improvement of educational access for students

from underprivileged family

- Payments made to educators by institutions or organizations that have educational objectives and are approved under subsection 44(6) of the Income Tax Act will be considered welfare expenditure. This classification allows these payments to be deducted as expenses, thus reducing the taxable income of the institutions involved. This change aims to encourage organizations to invest in educational staff and improve the overall quality of education in Malaysia. By recognizing these payments as welfare expenditures, the government is fostering an environment that supports educators and promotes educational initiatives.

- Expansion of Child Care Allowance to Include

Elderly Care

- Effective from the Year of Assessment (YA) 2025, employers will be able to claim further tax deductions on childcare allowances paid to employees, which will now also include allowances for elderly care, specifically for parents and grandparents. This change aims to support employees who are caring for both young children and elderly family members, acknowledging the increasing responsibilities many individuals face in balancing work and family care.

- Double Deduction for Structured Training

Programs (MySIP)

- The double deduction on expenses incurred by companies participating in the Structured Training Program (MySIP) under Talent Corporation will be extended to include students undergoing structured training by industry regulatory bodies. This extension will remain in effect until the Year of Assessment (YA) 2030. This initiative is aimed at encouraging companies to invest in training programs that equip students with the necessary skills and experience, thereby enhancing their employability and bridging the skills gap in the workforce. By providing these deductions, the government seeks to promote collaboration between industries and educational institutions, ensuring that training programs align with industry needs

- Tax Incentive for Hiring Disabled Person (OKU)

and Ex-Convicts

- Employers who hire people with disabilities (OKU) and ex-convicts will receive an incentive of RM600 per month for a total of three months, managed by the Social Security Organization (SOCSO). This initiative aims to encourage businesses to provide employment opportunities for these groups, promoting inclusivity and social responsibility within the workforce. The program is designed to ease the transition into the job market for individuals who may face barriers to employment, helping them gain valuable work experience while also supporting employers in their hiring efforts.